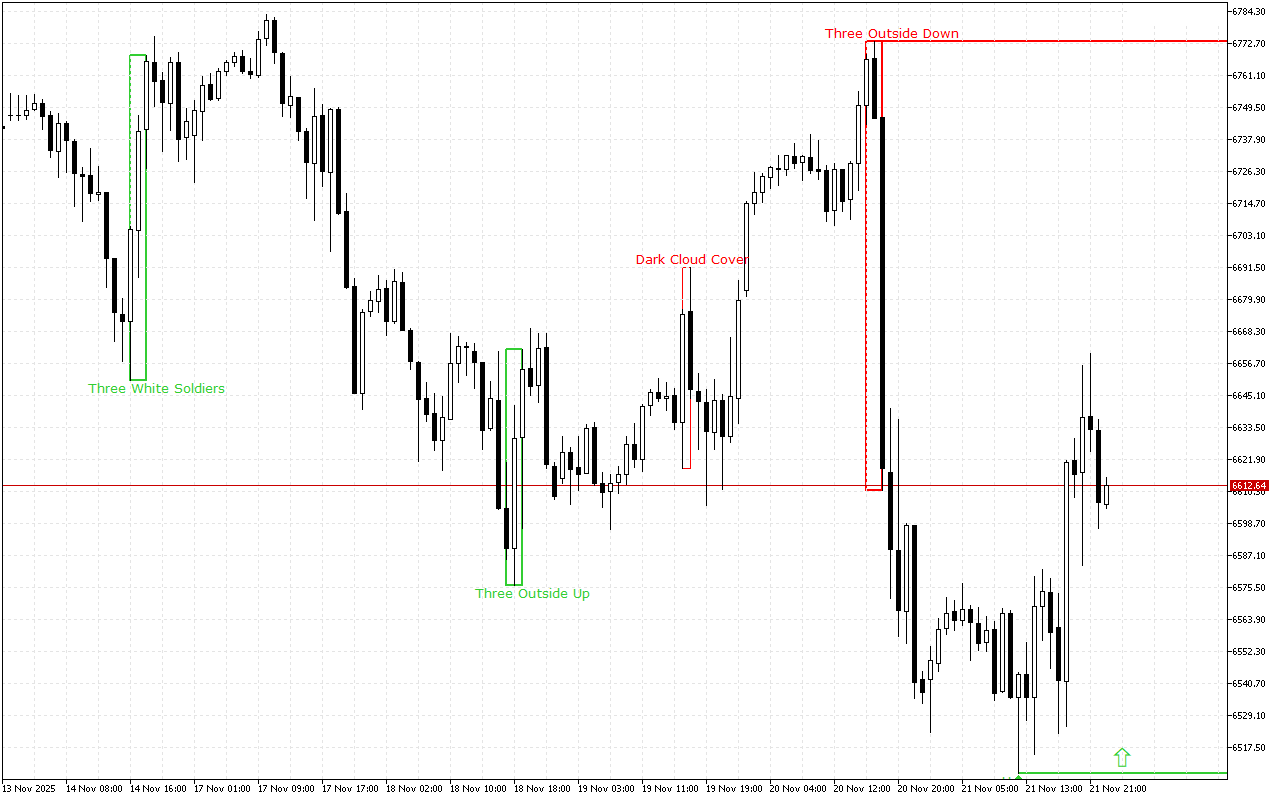

During the previous trading session, the price of S&P 500 decreased, moving in the main trend direction on the higher time-frame.

The support and resistance levels:

The support level is near the 6508.17 mark.

This level was formed by the Hammer pattern, also known as the Pin Bar pattern. This pattern is represented with a single Japanese candlestick which is composed of a small real body and a long lower shadow.

The resistance level is near the 6773.57 mark.

The pattern formed here is Three Outside Bars Down. This pattern is a combination of three Japanese candlesticks. The first candlestick has a short white real body, the second candlestick has a long black real body and completely engulfs the first candlestick, and the third candlestick is also black, closing below the second candlestick.

Trading recommendations:

Despite the downward dynamics prevail on a higher time-frame, the long position should be prioritized intraday. The latest signal on the chart indicates the prevalence of the upward movement intraday.